santa clara property tax rate

Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. In Santa Clara Countys case the tax rate equates to.

Los Angeles Property Tax Which Cities Pay The Least And The Most

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate.

. They range from the county to Town Of Santa Clara school district and many. 24 rows Living in beautiful Santa Clara County California means paying property taxes if you own your. For comparison the median home value in Santa Clara County is 70100000.

The average effective property tax rate in Santa Clara County is 073. Tax Rates by Tax Rate Area Numbers TRA. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Santa Clara County collects on average 067 of a propertys.

Yearly median tax in Santa Clara County. Tax rates can be complicated even without a lack of transparency so it is easier to look at the tax rate as a percentage of property value. Learn all about Santa Clara real estate tax.

Currently the average tax rate is 079. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Santa Clara County property tax rate.

The median property tax in. Santa Clara has to adhere to provisions of the California Constitution in establishing tax rates. See what your property tax dollars support.

In part by urban lines will vary whether you live in San José. TAX RATES The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. Property Tax Rate Book.

Whether you are already a resident or just considering moving to Santa Clara to live or invest in real estate estimate local property tax rates and learn. Santa Clara County collects on average 067 of a propertys. Property Tax Rate Book.

In reality tax rates cant be raised until the public is first alerted to that intent. See property tax rates and equalized assessed values. Property Tax Information Where My Taxes Go.

Tax Rate Book Archive. Property Tax Rates for Santa Clara County The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. Santa Clara County collects on average 067 of a.

Every entity sets its individual tax rate. The bills will be available online to be viewedpaid on the same day. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. It also limits increases on assessed. Remember that the precise rate of tax supplements approved by vote.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. The sum of levies made by all associated public entities. That value is multiplied times a composite tax rate ie.

Compilation of Tax Rates and Information. Under a combined tax bill most sub-county entities reach agreement for the county to levy and collect the tax on their behalf.

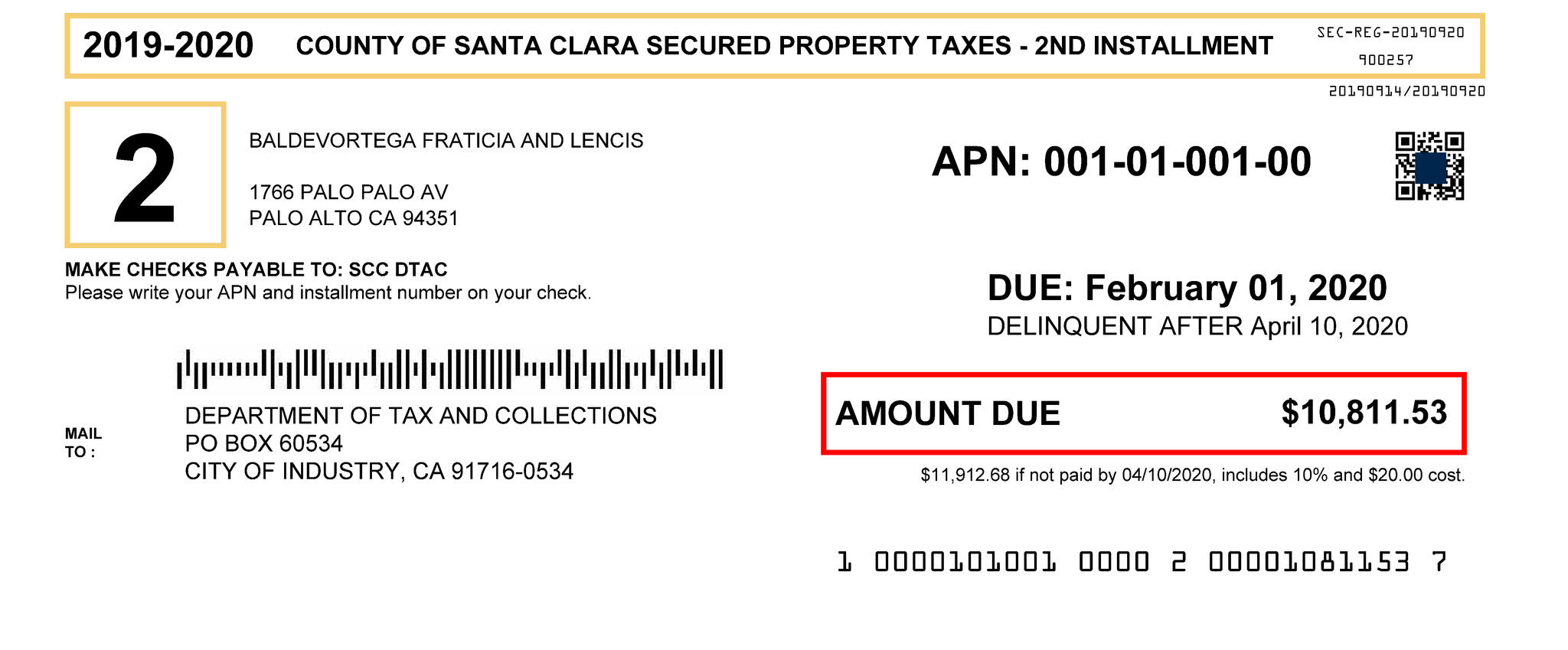

Second Installment Of Santa Clara County S 2019 2020 Property Taxes Delinquent After April 10 County Of Santa Clara Mdash Nextdoor Nextdoor

East Side Union High School District Bond Measure Faqs

California Sales Tax Rate Rates Calculator Avalara

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Santa Clara Historical District Washington County Of Utah

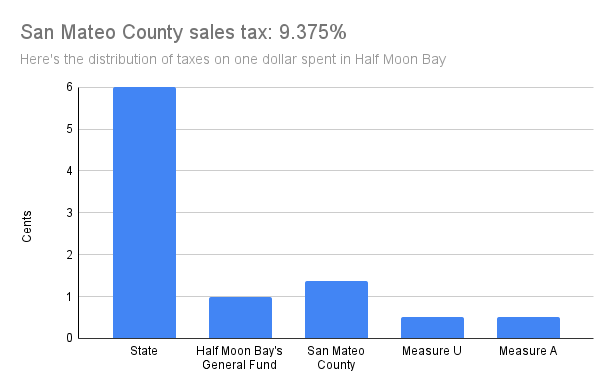

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

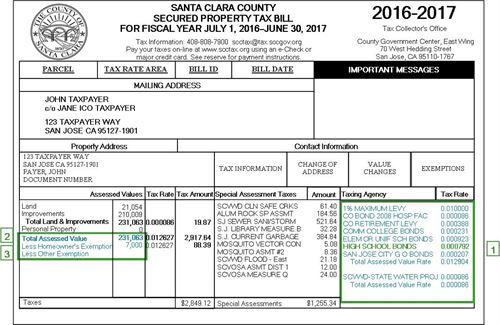

Property Tax Collector S Office Berkeley Advanced Media Institute

Understanding California S Property Taxes

How To Keep Your Old Property Tax Rate For A New House If You Are Over 55 Life Death Law Blog November 16 2016

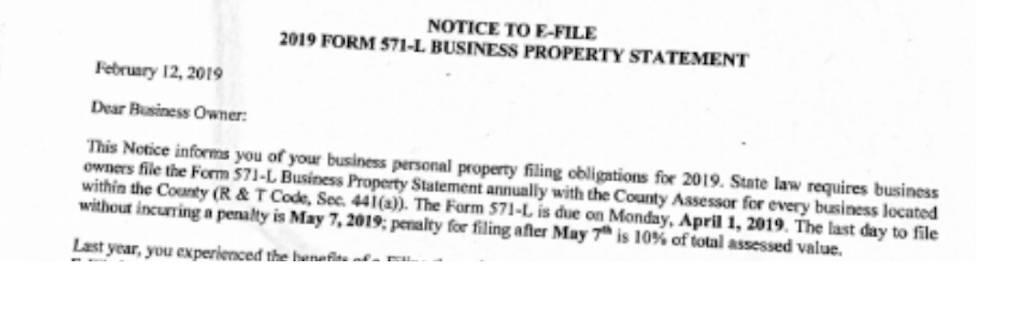

571 L Sf Property Tax Statements For California Startups

Property Tax By County Property Tax Calculator Rethority

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Calculator How Property Tax Works Nerdwallet

Santa Clara County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller